THE UNIVERSITY OF MINNESOTA FOUNDATION

Report for the periods ended March 31, 2024

At the University of Minnesota Foundation (UMF), our mission is to connect passion with possibility, inspire generosity, and support greatness at the University of Minnesota.

Designated by the University’s Board of Regents as the central development office for the University, UMF plays a key role in supporting the drive to discover across all five U of M campuses. We accomplish this by raising gifts from individuals and organizations, investing funds for maximum impact, and stewarding gifts to ensure they are used as donors intend.

People who wish to create a lasting legacy at the University may make endowed gifts to create new funds or contribute to existing funds. These funds are invested together as the University of Minnesota Foundation endowment, but are managed by UMF individually to benefit their designated University programs in accordance with donor intent.

The endowment portfolio is invested by the University of Minnesota Foundation Investment Advisors (UMFIA).

Investing the endowment

Goals and strategy

The UMF endowment is managed to meet two goals: preserve the inflation-adjusted value of endowed gifts for the long term, while simultaneously supporting a meaningful and dependable rate of spending from the funds each year.

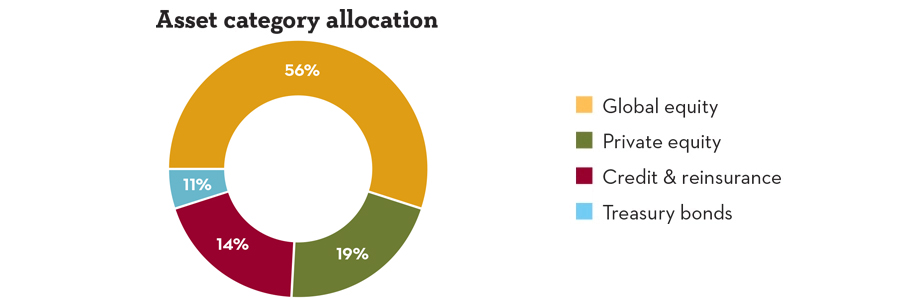

To achieve this, UMF’s portfolio is highly diversified and actively managed by UMFIA. It is uniquely structured to perform comparatively well during multi-year periods of market volatility while capturing equity-like returns over time.

To achieve our long-term goals, the portfolio accepts considerable year-to-year performance variability. However, the investment strategy and endowment spending policy are designed to limit the effects of this variability on the endowment’s payout to University programs in both the near and long term.

Investment results

The investment goal is to achieve an annualized return of 5% in excess of inflation in order to cover the 4.5% spending rate as well as administrative expenses.

The UMF endowment’s one-year return for the period ended March 31, 2024 was +14.9%. The one-year return of the endowment’s private investments lagged the return of publicly traded stocks. As a result, the 65/35 market benchmark’s return of +15.5% surpassed the endowment’s return. The rate of inflation continued to normalize, but remained elevated at about 3.5% during the trailing year, resulting in a return goal of 8.6%.

For the periods ended March 31, 2024.

Total value of UMF endowment: $3.6 billion.

Year |

Actual |

Goal |

Policy

|

65/35 Market

|

|---|---|---|---|---|

| 1-year | 14.9% | 8.6% | 15.4% | 15.5% |

| 5-year | 10.5% | 9.4% | 8.0% | 7.1% |

| 10-year | 8.4% | 8.0% | 7.0% | 6.1% |

| Since inception3 | 8.2% | 8.2% | 6.9% | 5.5% |

Long-term performance

Growth over time

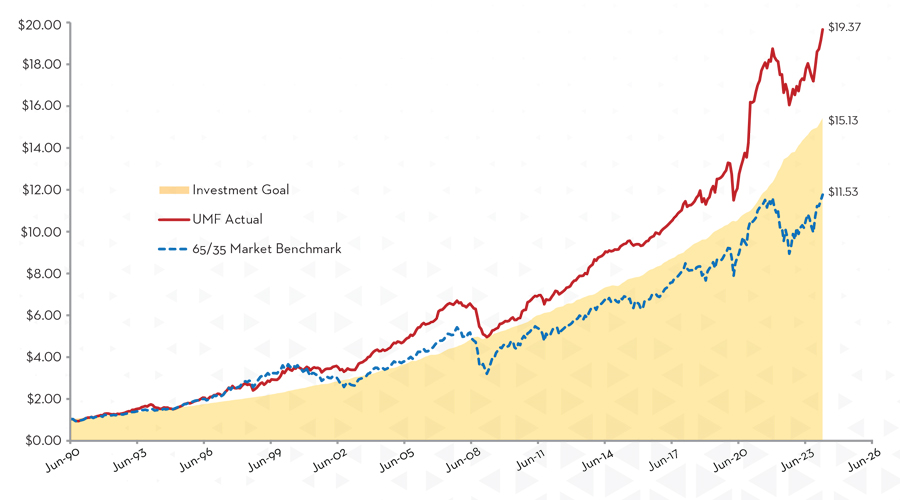

The chart below shows the growth of $1 invested in the UMF endowment in 1990 compared with the foundation’s investment goal and a 65/35 market benchmark.

Over this multi-decade period, UMF’s returns have exceeded the investment goal, which translates to more dollars available to support the University than projected. One of the benefits of endowed funds is that they harness the power of compounding to amplify this growth for the benefit of future generations. Since UMFIA’s inception in 1999, our portfolio also has outperformed the market benchmark by +2.7% annually, with less downside risk.

Growth of $1 in UMF Endowment

July 1, 1990 to March 31, 2024

Spending the endowment

UMF’s endowment spending policy

The UMF Board of Trustees determines the amount that can be made available for spending from endowed funds each year. This is referred to as the Foundation’s endowment spending policy.

The spending policy is designed to provide stable and predictable funding to our donors’ designated University programs in perpetuity. The current spending policy is to distribute 4.5% of an endowed fund’s trailing average principal balance over the previous 20 quarters (5 years) for spending each year. These dollars, called the fund’s “payout,” are transferred to a spending account and made available to the University to support the fund’s designated program. Quasi-endowment funds allow spending of up to 20% of the fund’s value annually.

For permanent endowment funds, investment earnings above and beyond the 4.5% payout are reinvested back into the fund’s principal to maximize long-term growth and impact.

Administrative fees and efficiency

UMF is dedicated to keeping administrative fees low. This reflects our strong commitment to efficiency and maximizing the impact of donor gifts.

The fee for permanent endowments is 0.8% and for quasi-endowments is 1.5%. These fees help fund the related costs of fund and gift administration, including gift receipting, distributing funds to the University, cash management and general accounting, monitoring, and reporting.

Print booklet version (use 11x17 and fold for best results)